Buying a property in Spain is a dream for many, but without the right guidance it can quickly turn into a legal or financial nightmare. Whether you’re relocating, investing, or searching for a second home under the sun, Spain’s real estate system can be complex, especially for foreigners.

From hidden costs and legal gaps to tax rules for non-residents and Brexit-related restrictions for British buyers, understanding how to buy safely is essential. This guide covers everything: the best areas to invest, legal requirements, common pitfalls, costs, taxes, and how to secure a deal whether you’re paying with cash or applying for a mortgage.

If you want peace of mind throughout the process, make sure you work with a trusted conveyancing solicitor who knows how to protect your interests. Keep reading to discover everything you need to know before buying a home in Spain.

Why Spain? Why now?

Spain continues to rank among the top destinations for international property buyers and for good reason. With its Mediterranean climate, relaxed lifestyle, excellent healthcare system, and vibrant culture, the country offers an exceptional quality of life. Whether you’re dreaming of seaside living in Alicante and the Costa Blanca, a cosmopolitan flat in Madrid, or a countryside retreat in Andalusia, Spain has something for every type of buyer.

From an investment standpoint, buying a property in Spain now is more appealing than ever. Property prices in many regions remain competitive compared to other European markets, yet demand, particularly in coastal and urban areas like Alicante is rising steadily. For those seeking rental income, short- and long-term let’s remain in high demand among tourists, students, and digital nomads.

Post-pandemic trends and post-Brexit shifts have also opened new opportunities. With favorable conditions for EU and non-EU citizens alike, now is a strategic time to secure your ideal home in Spain before prices rise further.

Is it difficult to buy properties in Spain for foreigners?

It is absolutely possible and often easier than you might expect. However, it requires understanding the legal framework, the tax implications, and the bureaucratic steps involved.

Buying after Brexit as a British citizen

Since the UK left the EU, British citizens are now considered non-EU buyers which means they face a few extra steps. While you can still buy property in Spain after Brexit, you may need to secure a visa for long-term stays (such as the non-lucrative visa). You’ll also be subject to the same rules as other third-country nationals when it comes to taxes and length of stay, 90 days within a 180-day period unless you apply for residency.

Still, British buyers remain one of the largest groups of foreign homeowners in Spain, especially in areas like Alicante and the Costa Blanca, where local infrastructure is already well adapted to serve international residents.

EU Citizen or American buyers

If you’re an EU citizen, the process is much simpler. You can live, work, and buy property in Spain without the need for a visa. That makes purchasing a home here particularly smooth, especially when combined with the shared legal protections and banking access across EU countries.

For American citizens, the process is also straightforward, though you’ll be treated as a non-resident. You can still own property without restriction, but you’ll need an NIE (Número de Identificación de Extranjero) and should be aware of the visa requirements if you plan to spend extended periods in Spain.

What non-residents need to know

If you’re buying a home in Spain without planning to become a resident, there are a few key considerations:

- You’ll need an NIE (Foreigner Identification Number) before you can complete any real estate transaction.

- Non-residents are subject to different tax rates, particularly on rental income and capital gains.

- You’ll likely need to open a Spanish bank account and may face stricter mortgage conditions, often requiring higher down payments.

- Certain areas near military or coastal zones may require additional authorisations for non-EU buyers.

In short, foreigners can safely and legally buy property in Spain, but working with a professional lawyer or solicitor who understands the needs of international clients.

How to buy a property in Spain: step-by-step

Whether you’re an expat, investor, or second-home buyer can be a smooth and secure process when you follow the right steps and have the right professionals by your side.

Researching the market and best areas in Spain

Before anything else, take time to understand the Spanish property market and define what you’re really looking for. Are you buying a property in Spain to relocate permanently, invest in a rental, or enjoy as a holiday home? Each goal may lead you to different regions.

It’s also wise to research the property types available in each area, flats, townhouses, villas, and compare resale and off-plan options. Pay close attention to infrastructure, access to airports, public services, and lifestyle factors.

Hiring an independent solicitor

Once you’ve identified the right location and property type, the next essential step is hiring an independent real estate lawyer, someone who represents only you and not the developer or estate agent.

An experienced conveyancing solicitor will also help you avoid common traps: signing premature agreements, losing deposits, or taking on debts tied to the property. They’ll also be able to explain tax implications, draft a power of attorney if you can’t be in Spain for every stage, and liaise directly with notaries, registrars, and town halls on your behalf. A good lawyer can save you from costly mistakes.

Due diligence and legal checks

Once you’ve appointed your lawyer, they will begin the due diligence process to make sure the property is safe to purchase.

- Checking the Land Registry for title deeds, mortgages, and embargoes.

- Confirming urban planning compliance with the Town Hall.

- Verifying property size and use with the Cadastre.

- Reviewing utility debts, community fees, and tax arrears.

For new builds or off-plan homes, they will also confirm building permits, insurance guarantees, and the developer’s solvency.

Signing the private contract

Once the property has passed all checks and both parties agree on the terms, you will sign the private purchase contract. This is a legally binding agreement that outlines the sale price, payment terms, timeline, and specific conditions (such as including furniture or requiring repairs).

A deposit, typically 10% of the total price, is paid at this stage to reserve the property. This is a critical legal step, so your solicitor must review or draft the contract on your behalf to ensure your interests are protected.

Final deed and payment

The next milestone is the signing of the public deed of sale before a Spanish notary. This is when the remaining balance is paid and legal ownership of the property officially transfers from the seller to the buyer. The notary will also confirm the payment of relevant taxes, such as Transfer Tax or VAT, depending on the nature of the property. If you’re using a mortgage, the bank’s representative will also attend the signing.

After the signing, you’ll receive the keys and a certified copy of the deed, while the original is sent to the Land Registry for registration. Your solicitor will oversee the transaction to ensure that funds are released correctly and that no final surprises arise at this critical moment.

Post-sale formalities

After the deed is signed, your solicitor takes care of the remaining formalities. These include registering the property in your name, updating the Cadastre (land registry), switching over utilities, and paying any necessary taxes. If you’re a non-resident, they’ll also guide you through the relevant property declarations and ensure compliance with Spanish tax regulations.

Common pitfalls while you are buying a property in Spain

It’s easy to fall into avoidable traps, especially if you’re unfamiliar with the legal system or trust the wrong people. Here are some of the most frequent and costly mistakes made by foreign buyers.

Off-plan property traps

Off-plan properties can seem like a great deal, offering modern amenities, attractive prices, and flexible payment plans. However, they also carry more risk. One of the most common mistakes is paying deposits without receiving a bank guarantee. This financial safeguard is required by Spanish law to protect your money if the project is delayed or never completed. Without it, you may struggle to recover your investment if things go wrong.

Another issue is vague or open-ended delivery dates written into the contract. Terms like “expected completion in Q4 with possible extensions” are red flags. Your lawyer should ensure the contract clearly specifies a firm delivery date and that all promotional promises—floor plans, finishes, pool access—are included in writing. Always verify the developer’s reputation, past projects, and financial health before signing anything.

Verbal promises vs. legal guarantees

It’s not uncommon for real estate agents or sellers to make verbal assurances during viewings: “The terrace is included,” “That wall will be fixed,” or “You’ll have access to the community pool.” While these comments might be sincere, they are not legally binding unless stated in the contract.

Relying on spoken promises is one of the fastest ways to lose money or end up with a very different property than expected. In Spain, only what’s written into the contract counts. If a feature, fixture, or agreement isn’t in the paperwork, it may not be enforceable.

Buying without legal representation

Perhaps the biggest and most damaging mistake a foreigner can make is trying to buy a property in Spain without a conveyancing solicitor. Some buyers believe they can rely on the estate agent or notary to guide them, but these professionals do not work for you.

Without legal support, buyers can unknowingly sign contracts that include abusive clauses, overlook hidden debts, or commit to purchases with unresolved legal issues. A lawyer with experience in real estate and foreign clients will carry out proper due diligence, ensure all taxes are accounted for, and guarantee that the transaction is secure and transparent.

Hidden liabilities and unlicensed construction

Spain has thousands of properties, especially in rural or coastal areas, that were built or expanded without proper licences. What might seem like a spacious villa with a sunny terrace could, in fact, be partially illegal and subject to demolition orders or steep fines. This is particularly common in older properties or areas where rapid development occurred without strict oversight.

In addition to licensing problems, some homes carry hidden liabilities, such as unpaid utility bills, property tax debts, or even claims from previous owners or heirs. These don’t disappear with a new deed and can fall onto the new owner if not identified beforehand.

Costs and fees of purchasing a property in Spain

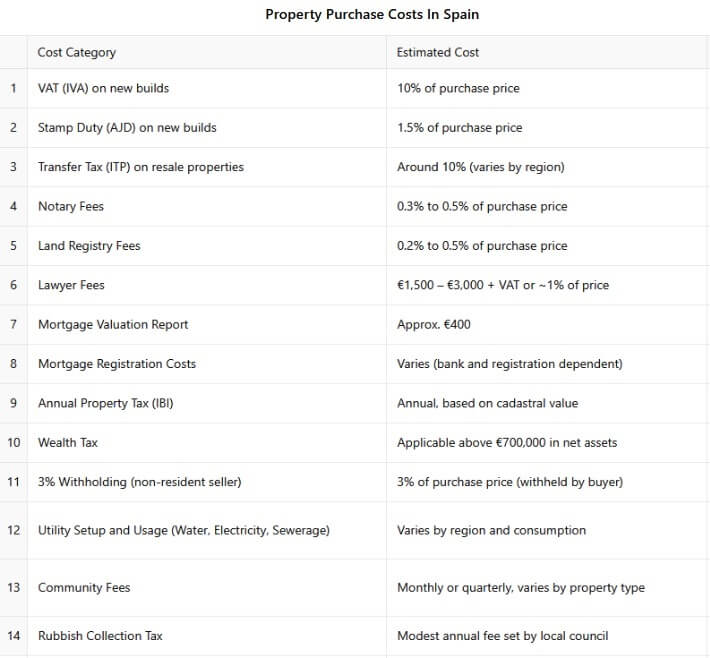

Understanding the true cost is essential—especially for foreign buyers who may not be familiar with local taxes and legal expenses. Here’s what to expect.

Property taxes: VAT, ITP, and stamp duty

This is one of the largest costs involved in buying a property in Spain and should be budgeted accordingly. The tax you’ll pay depends on whether the property is new or resale:

- For new builds, you’ll be charged 10% VAT (IVA) on the sale price, plus an additional 5% stamp duty (AJD)—especially in regions like Valencia and the Costa Blanca. In this case, there’s no need to pay Transfer Tax.

- If you’re buying a resale property, you’ll pay Transfer Tax (Impuesto de Transmisiones Patrimoniales, or ITP) This is usually 10% of the purchase price in most regions, although it may vary slightly depending on the autonomous community.

Notary and Registration Fees

The signing of the public deed before a notary is a mandatory step in the purchase process. These expenses, while relatively modest, are essential for ensuring that your ownership is legally recognised in Spain.

- While notary fees can be negotiated in some cases, they are typically paid by the buyer and range from 0.3% to 0.5% of the property’s declared value. The exact cost depends on the complexity and value of the transaction.

- Afterward, the property must be registered in your name at the Land Registry. Registration fees usually add another 0.2% to 0.5% of the purchase price.

Lawyer fees and mortgage costs

Hiring an independent conveyancing solicitor is highly recommended and typically costs around 1% of the purchase price, although it may vary depending on the complexity of the deal. In many cases, lawyers charge a flat fee between €1,500 and €3,000, plus VAT. This covers legal checks, drafting or reviewing contracts, attending the notary signing, and post-sale formalities like tax registration.

If you are applying for a mortgage in Spain, be prepared for additional costs. These include the bank’s valuation report (usually around €400), and administrative fees for registering the mortgage deed with both the notary and the Land Registry.

Annual property taxes and wealth tax

It’s important to include this in your long-term cost planning, especially if you hold multiple properties or valuable assets in Spain. You’ll be responsible for ongoing annual taxes.

- The main one is the IBI (Impuesto sobre Bienes Inmuebles), which is similar to council tax and is based on the cadastral value of the property. This value is usually lower than the market price and is determined by the local municipality.

- You may also be subject to wealth tax if your total net assets in Spain exceed €700,000 (per individual, excluding a personal allowance for your main home). This tax is calculated annually as of December 31st, and rates vary by region and value brackets.

Other costs to bear in mind

In addition to taxes and legal fees, there are several secondary expenses that buyers often overlook when calculating the true cost of buying a property in Spain.

- If the seller is not a Spanish resident, it’s mandatory for the buyer to withhold 3% of the purchase price and pay it directly to the Spanish Tax Office as an advance on the seller’s capital gains tax liability. The remaining 97% is then transferred to the seller at completion.

- Once the property is yours, you’ll be responsible for setting up and paying for water, electricity, and sewerage services. These utility costs can vary by region and usage.

- Additionally, if your property is located within a residential complex or shared development, you’ll also need to pay community fees, which cover maintenance of common areas, cleaning, security, and sometimes pool or lift services.

- Another common charge is the rubbish collection tax, which is levied annually by the local council. Though usually modest, it must be paid on time to avoid penalties.

Tax considerations for foreign buyers

When buying a house in Spain, it’s essential to understand your tax obligations—both at the time of purchase and on an ongoing basis. As a foreign buyer, your residency status, country of origin, and intended use of the property (personal vs. rental) will determine the taxes you’re liable to pay.

Taxes for non-residents

If you do not live in Spain for more than 183 days a year, you are considered a non-resident for tax purposes. As a non-resident property owner, you’ll need to file an annual tax return even if you don’t rent out the property. This tax is called the non-resident imputed income tax (210 form), calculated on the cadastral value of the home (not the market value), and it assumes you derive a theoretical benefit from owning the property.

Non-residents must also appoint a tax representative in Spain and obtain an NIE (Foreigner Identification Number) before the property purchase is finalized. Failure to submit your annual return can lead to fines and complications when selling the property in the future.

Rental income tax and capital gains

If you plan to rent out your Spanish property, the income you earn is subject to rental income tax in Spain:

- EU residents can deduct certain expenses (like repairs, insurance, and maintenance), and are taxed at a flat rate of 19% on net profits.

- Non-EU residents—including Americans and post-Brexit British citizens—are taxed at 24% on gross rental income, with no deductions allowed.

When you sell your property, you may also be liable for capital gains tax on the profit made from the sale. The rate varies depending on the amount of gain and your residency status, with non-residents paying the same progressive rates as residents: 19% for gains up to €6,000, 21% up to €50,000, and 23% above that.

Double taxation agreements

Spain has signed double taxation treaties with many countries, including the UK, USA, Canada, and most EU member states. These agreements are designed to prevent you from being taxed twice on the same income or capital gains—once in Spain and again in your home country.

If you are paying taxes in Spain as a non-resident, you may be able to offset these payments against your domestic tax obligations, depending on your country’s laws and the terms of the treaty.

Contact Pellicer & Heredia to buy safely in Spain

Buying a house in Spain doesn’t need to be stressful, especially with a clear plan and expert support at every stage. At Pellicer & Heredia, we’ve helped thousands of international clients buy safely, securely, and with full peace of mind.

Our dedicated Real Estate Department specialises in assisting expats, non-residents, and international investors throughout the entire conveyancing process. From due diligence and contract review to Power of Attorney and tax representation, we ensure that every legal step is handled with transparency and precision, so you can focus on enjoying your new life in Spain.

Contact us today for a personalised consultation whether you’re buying in Alicante, the Costa Blanca, or anywhere in Spain, we’re here to protect your interests from start to finish.Final del formulario